Taxes for Marion County homes are determined by the home’s appraised value and the family wealth threshold, which is the lowest possible tax. The appraised value is the current market value of the home as reported by the county tax office.

or

On property exemption certificates, the county allows a resident to build a vacation home or an entire home on the property. If you build more than necessary, the county will reimburse you. However, you could lose your property exemption if you increase the size of your home after you build it.

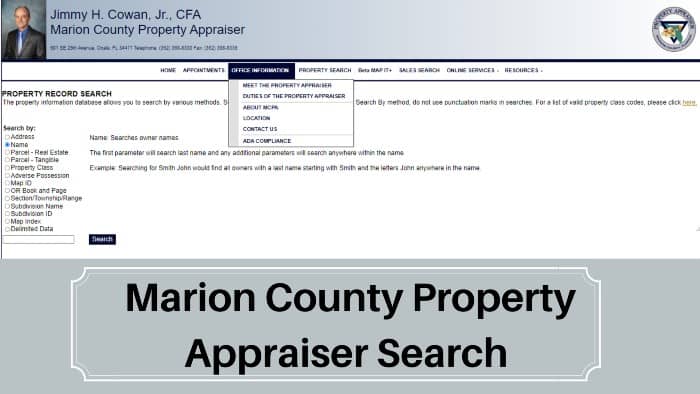

Steps To Search The Property Through Website

You will receive information about your property value when you sign up.

Go To The Website

Visit Realtor.com to check your property’s value or to find other properties.

Click Initial Value

You can perform various searches on the site. So, to ensure that you get the property value details, click the Property Value option before hard-coding the property details. Find real estate appraisers online

Write The Address

Enter your accommodation address in the search bar and click Search. You will immediately receive an estimate of the value of your property.

Sign Up For Updates

Once the estimated value of your property is displayed, you have the opportunity to register. If you’d like to receive regular updates about your property and keep track of changes in value, it’s best to subscribe.

However, if it is a commercial property that interests you, you can visit the Commercial Property Appraisal. They will be happy to help you estimate your property.

You can contact the Marion County Adviser’s Office starting at 8:00 am. We meet 8:30 a.m. to 4:30 p.m., Monday through Friday, at the Marion County Courthouse, 300 E. Old Main St., P.O. Box 532, Yellville, AR 72687 or call 870-449-4113 or email [email protected]. The process of obtaining and approval of urbanization and employment can be printed from this downloadable application.